Every bank requires 2 important pieces of advice to spot clients: the routing number and the account number, both that can be delegated should you start a merchant account. Whether you have to put up a direct-deposit , including your pay check or order checks on line, you'll need your bank's routing number and your own account number for anyone trades.

Account amounts are much such as an individual ID, or fingerprint, which is specific to every account holder. In the same way, routing amounts identify each banking association with a distinctive numerical ID. Routing and accounts numbers are delegated to signify wherever capital within a trade are originating from and going to. Whenever you create an electronic funds transfer, for example, the routing and account numbers has to be offered to the applicable fiscal associations.

The routing number (some times known as an ABA routing number, in respect to this American Bankers Association) is really a succession of eight specimens utilized by banks to spot specific finance institutions within america. This number demonstrates that the financial institution is a national - or state-chartered association also that it preserves a merchant account with the Federal Reserve.

Small banks normally have a single routing number, whereas large multi national banks might have a lot of diverse kinds, usually dependent on their condition in that you support the accounts. Routing numbers are most frequently demanded when re ordering checks, for example payment of customer invoices, to set an immediate deposit (for instance, a pay check ), or even to get taxation obligations. The routing amounts utilized for national and global wire transfers aren't similar as the ones recorded in your own tests. But they could certainly be accessed on the web or by calling your lender card.

The accounts number works in combination with all the routing number. As the routing number defines the name of this standard bank , the accounts number--usually between 2 and 12 specimens --defines your personal account. If you have two accounts at precisely the exact same bank, the routing amounts will probably, generally, be exactly the same, however your accounts amounts will probably differ.

Your account number is obligatory for every possible banking trade , if within the bank at which the account is stored or between finance associations.

Anybody can find a bank routing number, however, your telephone number is unique for you, therefore it's crucial to shield that, as you would your Social Security number or PIN code.

Routing Number vs. Account-number Example

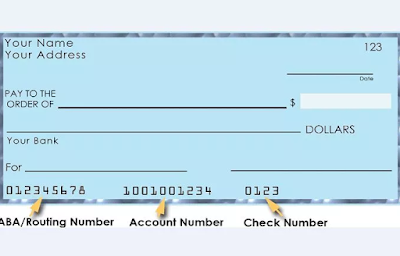

You ought to be ready to find either the routing number and account number by logging in to your internet checking accounts. It is also possible to see them in your own tests. At the base of each test, you are going to observe three types of amounts: routing amounts (again( normally two digits) appear like the first set, the accounts number generally includes instant, and the 3rd could be that the particular check amount. Some times, however, like on official credit checks, those amounts can come in an alternative order.

This collection of numbers is inserted using magnetic ink, referred to as the test's MICR (Magnetic Ink Character Recognition) lineup .

Account amounts are much such as an individual ID, or fingerprint, which is specific to every account holder. In the same way, routing amounts identify each banking association with a distinctive numerical ID. Routing and accounts numbers are delegated to signify wherever capital within a trade are originating from and going to. Whenever you create an electronic funds transfer, for example, the routing and account numbers has to be offered to the applicable fiscal associations.

The routing number (some times known as an ABA routing number, in respect to this American Bankers Association) is really a succession of eight specimens utilized by banks to spot specific finance institutions within america. This number demonstrates that the financial institution is a national - or state-chartered association also that it preserves a merchant account with the Federal Reserve.

Small banks normally have a single routing number, whereas large multi national banks might have a lot of diverse kinds, usually dependent on their condition in that you support the accounts. Routing numbers are most frequently demanded when re ordering checks, for example payment of customer invoices, to set an immediate deposit (for instance, a pay check ), or even to get taxation obligations. The routing amounts utilized for national and global wire transfers aren't similar as the ones recorded in your own tests. But they could certainly be accessed on the web or by calling your lender card.

The accounts number works in combination with all the routing number. As the routing number defines the name of this standard bank , the accounts number--usually between 2 and 12 specimens --defines your personal account. If you have two accounts at precisely the exact same bank, the routing amounts will probably, generally, be exactly the same, however your accounts amounts will probably differ.

Your account number is obligatory for every possible banking trade , if within the bank at which the account is stored or between finance associations.

Anybody can find a bank routing number, however, your telephone number is unique for you, therefore it's crucial to shield that, as you would your Social Security number or PIN code.

Routing Number vs. Account-number Example

You ought to be ready to find either the routing number and account number by logging in to your internet checking accounts. It is also possible to see them in your own tests. At the base of each test, you are going to observe three types of amounts: routing amounts (again( normally two digits) appear like the first set, the accounts number generally includes instant, and the 3rd could be that the particular check amount. Some times, however, like on official credit checks, those amounts can come in an alternative order.

This collection of numbers is inserted using magnetic ink, referred to as the test's MICR (Magnetic Ink Character Recognition) lineup .

No comments:

Post a Comment